Property Vs. Stocks & Shares

Weighing the Challenges of Two Popular Investment Paths for UK Investors

For many UK investors in the wealth accumulation phase, deciding where to invest can be just as important as deciding whether to invest. Property and stocks & shares are two of the most popular investment routes—but each comes with unique advantages, tax implications, risks, and planning considerations that can heavily impact your long-term financial security and legacy planning.

At Blackstone Wealth, we understand how critical it is to navigate these options with clarity, confidence, and an eye on tax efficiency. Our expert financial planning helps you build an investment portfolio tailored to your lifestyle, values, and retirement goals.

Property Investment in the UK: Benefits and Growing Complexities

Property investment remains a favourite for many UK investors because it offers a tangible asset, a sense of control, and historically strong returns—particularly in the residential buy-to-let market. However, recent regulatory changes and tax reforms have increased the complexity and cost of owning investment property.

Key Advantages of Property Investment:

Steady Rental Income: Rental yields provide a predictable income stream, valuable for cash flow management.

Perceived Stability: Property prices tend to be less volatile than equities, appealing to cautious investors.

Leverage Opportunities: Buy-to-let mortgages enable you to amplify returns through borrowing.

Direct Asset Control: Investors can personally manage property maintenance, tenant selection, and improvements.

Challenges and Considerations:

Liquidity Constraints:

Property is a highly illiquid asset. Selling can take weeks or months, especially in down markets, and transaction fees—including solicitor costs, surveyor fees, and estate agent commissions—can significantly reduce net proceeds.Tax Burdens on Property Investors:

Recent UK tax reforms have impacted the profitability of property investments:Stamp Duty Land Tax (SDLT): Additional properties attract a surcharge, increasing upfront costs.

Mortgage Interest Tax Relief: Since 2020, higher-rate taxpayers no longer deduct mortgage interest from rental income, resulting in higher taxable income.

Capital Gains Tax (CGT): Property sales attract CGT at rates up to 28%, with the annual allowance reduced to just £3,000 from April 2024, limiting tax-free gains.

Income Tax: Rental income is taxed at your marginal rate, potentially pushing you into higher tax bands.

Disposal and Exit Challenges:

Selling property involves capital gains tax liabilities, professional fees, and often the need to wait for favourable market conditions. This can restrict your ability to quickly rebalance your investment portfolio or access cash when needed.Inheritance Tax (IHT) Exposure:

Investment properties are counted fully as part of your estate and face inheritance tax at 40% above the nil-rate band. The illiquid nature of property assets complicates the division of assets among heirs and can necessitate forced sales to meet tax liabilities.

Stocks & Shares: Flexible, Liquid, and Tax-Efficient Investment Vehicles

Stocks and shares provide an accessible, liquid way to grow wealth through equity markets, mutual funds, ETFs, and other collective investments. While equities can experience short-term volatility, they often outperform property in long-term growth and provide more flexible tax planning opportunities.

Advantages of Stocks & Shares Investing:

High Liquidity: Stocks and funds can typically be bought or sold within days, offering quick access to funds.

Tax-Efficient Wrappers: ISAs (Individual Savings Accounts) and pensions shelter capital gains and dividends from tax, significantly improving net returns.

Low Transaction Costs: Compared to property transactions, stock trading often involves minimal fees.

Global Diversification: You can spread risk across international markets, sectors, and asset types, reducing concentration risk.

Range of Investment Strategies: Choose between passive index tracking, active management, or Shariah-compliant portfolios tailored to ethical investing principles.

Challenges to Consider:

Market Volatility and Emotional Discipline:

Daily fluctuations in equity values can be stressful, leading to emotional decisions such as panic selling or buying at peaks. Long-term discipline and a well-diversified portfolio help mitigate this risk.Tax Implications Outside of Tax Shelters:

Dividends and capital gains outside ISAs or pensions are subject to taxation, with allowances shrinking in recent tax years.

CGT rates of 18% or 24% apply, depending on your income bracket, with only a £3,000 allowance from April 2024.

Inheritance Planning Opportunities and Risks:

While stocks are also subject to IHT, their liquidity and flexibility mean they are easier to manage for estate planning. Business Property Relief (BPR) may apply to some shares (e.g., AIM-listed companies), potentially reducing IHT liabilities. Holding investments in trusts, pensions, or bonds can provide further tax advantages for passing wealth to future generations.

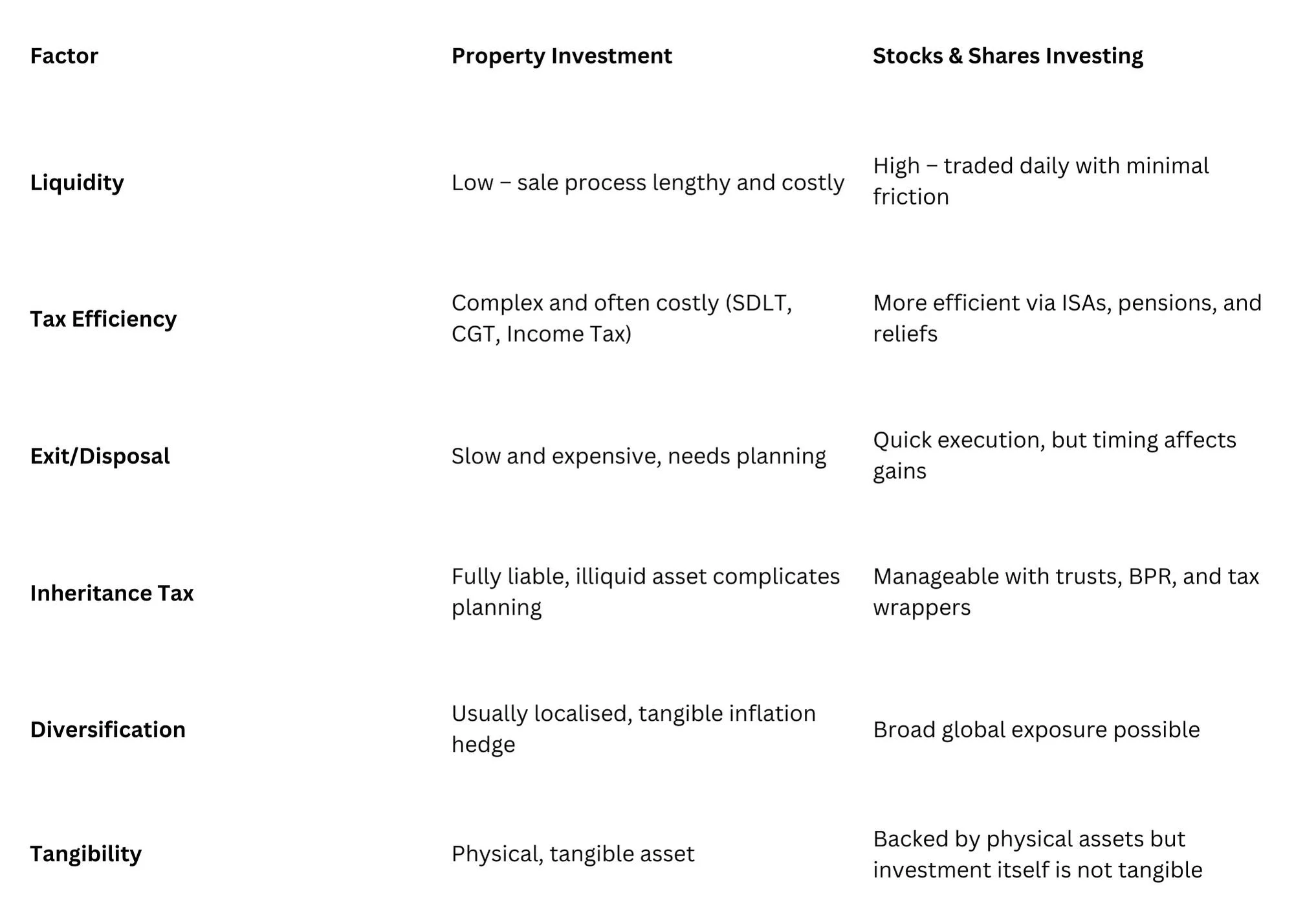

Comparing Property and Stocks: What UK Investors Need to Know

How to Build a Balanced, Tax-Efficient Investment Portfolio

The most prudent investment strategy often involves a blend of property and equities, structured to optimise tax efficiency, manage risk, and suit your personal circumstances, such as:

Maximising contributions to ISAs and pensions for tax-free growth and income.

Hold selected property assets with strong rental yields or expected capital growth.

For Muslim investors, explore Shariah-compliant portfolios and halal pensions to align investments with faith-based values.

Use estate planning tools like trusts, gifting, and insurance policies to mitigate inheritance tax exposure and ensure wealth is passed smoothly to heirs.

At Blackstone Wealth, we specialise in delivering tailored financial plans that reflect your unique goals, values, and legacy aspirations, helping you to confidently navigate these investment choices.

Whether you’re looking to rebalance an existing portfolio, explore tax-efficient investment options, or integrate Shariah-compliant solutions, our team at Blackstone Wealth offers expert guidance rooted in evidence, transparency, and care.

Book a free consultation today to start crafting a personalised plan that aligns with your financial future.

To find out more about investing, click the link below:

Why Blackstone Wealth?

At Blackstone Wealth, we believe in truly independent financial advice. With access to solutions from across the entire market, we’re not tied to any provider, ensuring our recommendations are always tailored to your unique needs

Respect

We respect every client, no matter their financial literacy or background.

Trust

The foundation of any relationship, we will always act in your best interest.

Service

We will always aim to deliver above and beyond your service expectations.

Value

Our independence enables us to access a wide range of products , ensuring we meet your needs.

Choosing a financial adviser is an important decision, and we understand it can feel daunting. That’s why we offer a free 30 minute consultation to discuss your goals and see if we’re the right fit for you

Ready to get in touch?

Get started on the path to financial success with Blackstone Wealth

Open Monday to Friday 9:30am - 6:00pm

Suite 500, AW House, 6-8 Stuart Street, Luton, Bedfordshire, LU1 2SJ