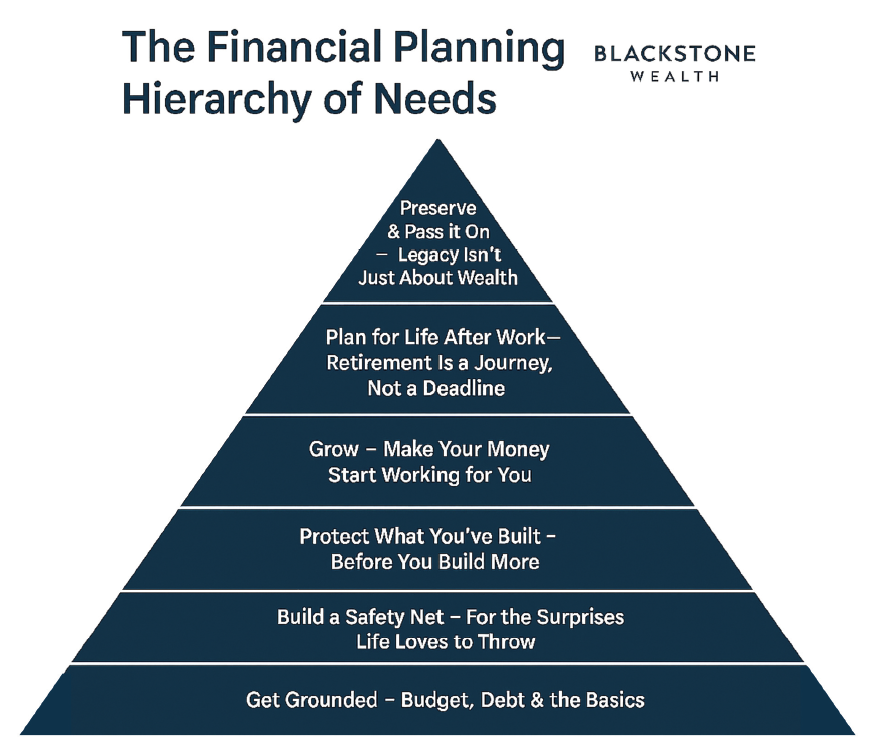

The Financial Planning Hierarchy of Needs

Building Wealth That Lasts

At Blackstone Wealth, we don’t chase trends. We build lives—layer by layer, starting with what really matters.

Just like Maslow’s hierarchy teaches us that human needs must be met in a certain order, true financial wellbeing follows a structure. You can’t plan for a future worth having without first securing today. From day-to-day stability to long-term legacy, each level of your financial life depends on the one below it.

That’s why we created the Financial Planning Hierarchy of Needs—a framework that reflects how real people live, work, protect, and plan. Whether you're just starting out or fine-tuning your final steps, this structure helps ensure no essential layer gets skipped.

Let’s walk you through it.

Level One: Get Grounded — Budget, Debt & the Basics

You can’t build wealth on shaky ground.

First, we help you get the essentials in order. That means knowing where your money’s going, cutting the dead weight, and protecting what matters most.

Budgeting that makes sense — We’re not here to judge your coffee habits. We’ll show you how frameworks like the 50-30-20 rule can create structure and space—without strangling your lifestyle.

Debt that doesn’t own you — Credit card rates, personal loans, old finance deals—these eat away at your progress. We help you prioritise, restructure, and clear the clutter.

Wills & LPAs — Because real security isn’t just about money. It’s about knowing that, if life takes a sharp turn, your wishes and loved ones are protected.

Level Two: Build a Safety Net — For the Surprises Life Loves to Throw

Before chasing growth, you need breathing room.

Emergency Funds — Life happens. Job loss. Boiler breaks. Health crisis. That’s why we suggest stashing at least three months’ income where you can reach it—quickly, without stress.

Short-Term Pots — Big birthday coming up? Need a new car soon? We help you plan for life’s near-term expenses without dipping into long-term savings or racking up debt.

Level Three: Protect What You’ve Built — Before You Build More

It’s hard to plan for the future if one unexpected event could undo it all.

Life Insurance & Critical Illness Cover — Not nice to think about, but essential. It’s not about you—it’s about protecting those you love, if the worst should happen.

Income Protection — If you can’t work, how will you pay the bills? We build plans that make sure your income doesn’t vanish just because you’re unwell.

Private Medical Insurance — Faster access to healthcare can be life-changing, especially for acute conditions. We help you weigh the pros and cons.

Level Four: Grow — Make Your Money Start Working for You

This is where real momentum begins.

You’ve got stability. You’ve got protection. Now, it’s time to think bigger.

Investing to Beat Inflation — Sitting on cash sounds safe. But over time, inflation eats it. We’ll show you how smart investing preserves and grows your buying power.

Tailored Portfolios — Your goals and risk tolerance are uniquely yours. We don’t do cookie-cutter. We build portfolios using everything from ISAs to pensions to investment bonds—designed around you.

Tax-Efficient Wrappers — Because paying unnecessary tax is… well, unnecessary. From SIPPs to LISAs to Junior ISAs, we help you keep more of what you earn.

Level Five: Plan for Life After Work — Retirement Is a Journey, Not a Deadline

Most people leave retirement planning too late. We help you start early—and plan with clarity.

Know Your Number — How much will you really need in retirement? We don’t guess—we calculate.

Layered Pension Strategy — Whether it’s your NHS pension, workplace scheme, or private SIPP, we make sure all your pots are talking to each other—and working in harmony.

Bridge the Gaps — We map the space between your retirement age and state pension entitlement, so there are no surprises later.

Level Six: Preserve & Pass It On — Legacy Isn’t Just About Wealth

You’ve built something worth protecting. Now it’s time to think beyond your lifetime.

Inheritance Tax Planning — It’s not just for the ultra-wealthy. We help you reduce (or eliminate) IHT through gifting, trusts, and strategic use of protection.

Wills & Trusts — You worked hard for your wealth. Let’s make sure it goes where you want it to—efficiently, privately, and without confusion.

Ready to Start? The first step is often the hardest—But it’s also the most important

You don’t have to have it all figured out. You just need a plan.

Whether you’re rebuilding from the ground up or fine-tuning the final layers of your financial structure, we’re here to help. Honest advice. Trusted expertise. And a process that always puts you first.

Why Blackstone Wealth?

At Blackstone Wealth, we believe in truly independent financial advice. With access to solutions from across the entire market, we’re not tied to any provider, ensuring our recommendations are always tailored to your unique needs

Respect

We respect every client, no matter their financial literacy or background.

Trust

The foundation of any relationship, we will always act in your best interest.

Service

We will always aim to deliver above and beyond your service expectations.

Value

Our independence enables us to access a wide range of products , ensuring we meet your needs.

Choosing a financial adviser is an important decision, and we understand it can feel daunting. That’s why we offer a free 30 minute consultation to discuss your goals and see if we’re the right fit for you

Ready to get in touch?

Get started on the path to financial success with Blackstone Wealth

Open Monday to Friday 9:30am - 6:00pm

Suite 500, AW House, 6-8 Stuart Street, Luton, Bedfordshire, LU1 2SJ